Tax Obligations for French Retirees in Spain

For a French citizen (retraité) who establishes Spanish Tax Residence, the application of the Spain-France Double Taxation Treaty (DTC) is paramount. This treaty governs where French-sourced retirement income is taxed and how double taxation is relieved.

1. Taxation of French Pensions

The DTC (1995, Article 18 & 19) clearly divides the taxing rights over French pensions based on whether they were earned in the public or private sector.

| Pension Type | Taxable Where? | Key Obligation in Spain |

| Private Sector Pensions | Exclusively in Spain | Declared as General Income (rendimientos del trabajo) in the Spanish Personal Income Tax (IRPF). This includes state pensions derived from previous private employment (e.g., CARSAT, Agirc-Arrco). France will generally cease withholding tax upon proof of Spanish residency. |

| Government Service Pensions | Exclusively in France | General Rule: Pensions paid by the French State or local authorities for public service (e.g., civil servants, military, teachers) are taxed only in France. HOWEVER, this income must still be declared in Spain for Exemption with Progression purposes. |

| Exception to Government Pension Rule | Exclusively in Spain | If the recipient of the French Government Pension is a Spanish national without French nationality, the pension is taxed only in Spain. |

Exemption with Progression (Exención con Progresividad):

Although your French Government Service Pension may be exempt from Spanish taxation, its amount is included in your total income calculation. This total income determines the marginal tax rate that is then applied to your other Spanish-taxable income (e.g., private pensions, interest, etc.), potentially pushing that income into a higher bracket.

2. Taxation of French Financial Assets

| Income Type | Taxable Where? | Double Taxation Relief |

| Dividends & Interest | Taxable in Spain (residence country). France may also levy a limited withholding tax (e.g., 15% on dividends per the DTC). | Spain must grant a tax credit in the IRPF for the tax legitimately paid in France. |

| Rental Income (French Property) | Taxable in both countries, but France has the primary right to tax. | Spain must grant a tax credit in the IRPF for the French tax paid on the rental income. |

| Assurance Vie (Life Insurance) | Highly complex and depends on the specific structure. The French tax advantages are often not recognized in Spain. Withdrawals or income may be taxed in Spain as investment income or capital gains. Expert advice is mandatory. | Spain taxes the income/gains; relief is provided according to the DTC if tax was withheld in France. |

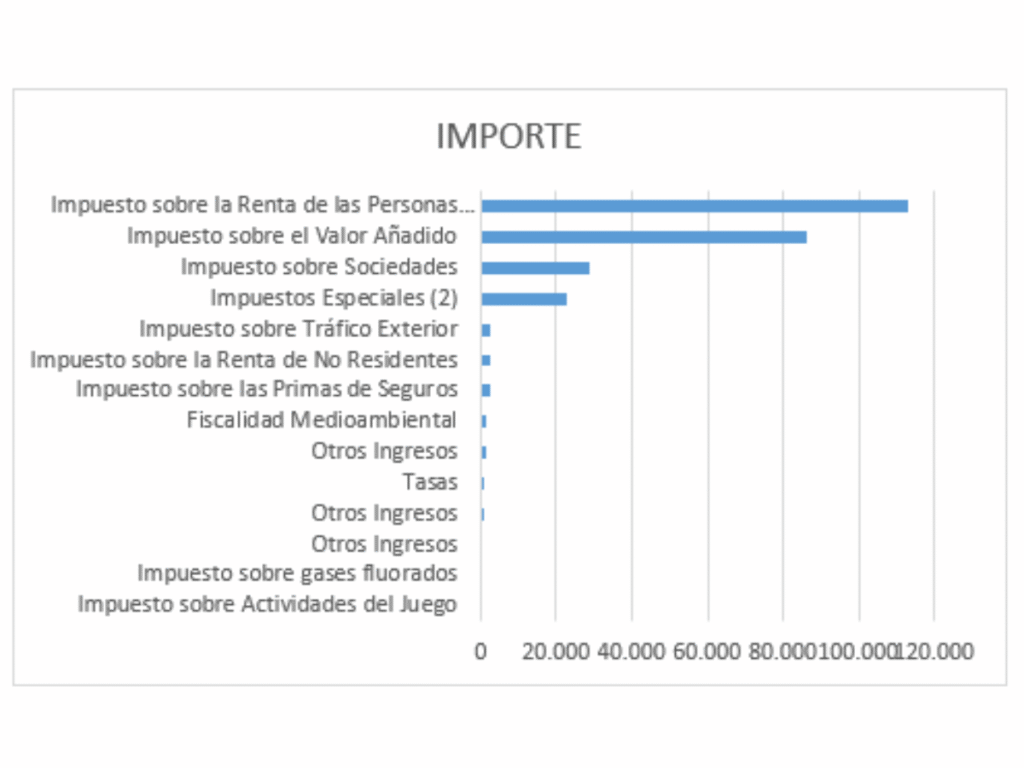

3. Key Spanish Declarations and Taxes

As a Spanish Tax Resident, you are subject to Spanish taxes on your worldwide income and assets, modified by the DTC.

- Personal Income Tax (IRPF – Modelo 100): You must file an annual return declaring all worldwide income. All French pensions (private and public) and investment income must be reported here to apply the correct tax credits and progression rules.

- Wealth Tax (Impuesto sobre el Patrimonio – Modelo 714):

- Spain levies an annual tax on worldwide net assets above a regional threshold (national standard is €700,000, though regional rules vary significantly).

- The DTC generally provides that assets (other than real estate) are only taxable in the country of residence (Spain).

- French Real Estate (Biens immobiliers): Property located in France may be subject to Wealth Tax in both countries (Spain and France, as France retains a limited Impôt sur la fortune Immobilière – IFI on real estate). Spain must apply a credit to avoid double taxation on the French property.

- Declaration of Overseas Assets (Modelo 720):

- Spanish tax residents must declare all foreign assets in three categories (bank accounts, investments/rights/insurance, and real estate) if the value in any category exceeds €50,000.

- Mandatory for French Retirees: French bank accounts, Assurance Vie policies, and any French property must be declared if the threshold is met. Failure to file or incomplete filing carries severe, high penalties.