How Much Do You Need to Retire in Spain?

Start Exploring Your Retirement Options Today with our Spain cost of living Calculator. Are you considering retiring in Northern Spain? Our Spain cost of living calculator is here to help you estimate your monthly expenses based on your chosen city and lifestyle preferences. Simply select your city and the services you plan to include in your budget, such as rent, utilities, and leisure activities.

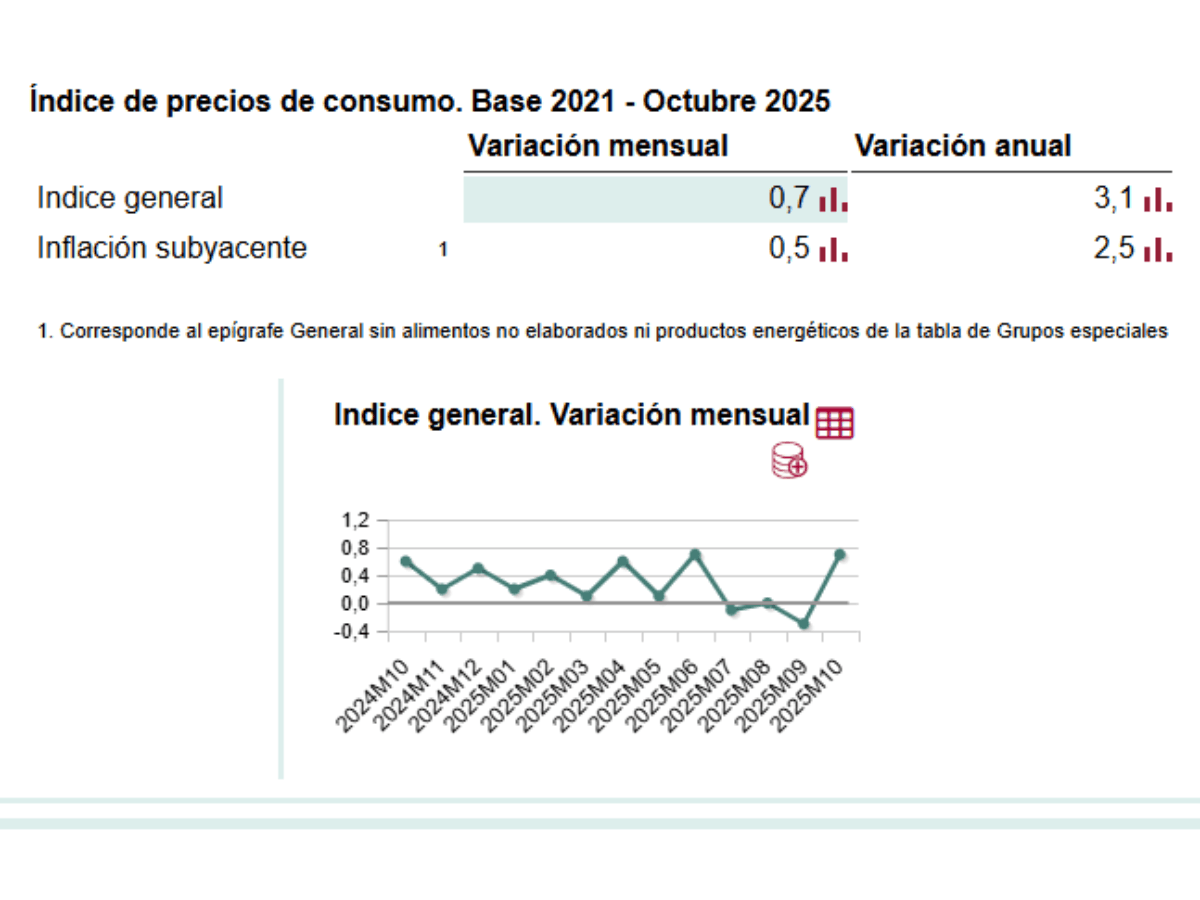

Official Figures INE (Instituto Nacional de Estadística)

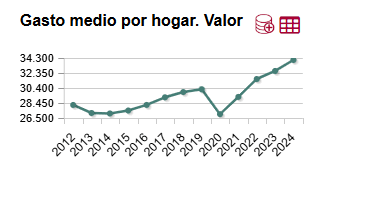

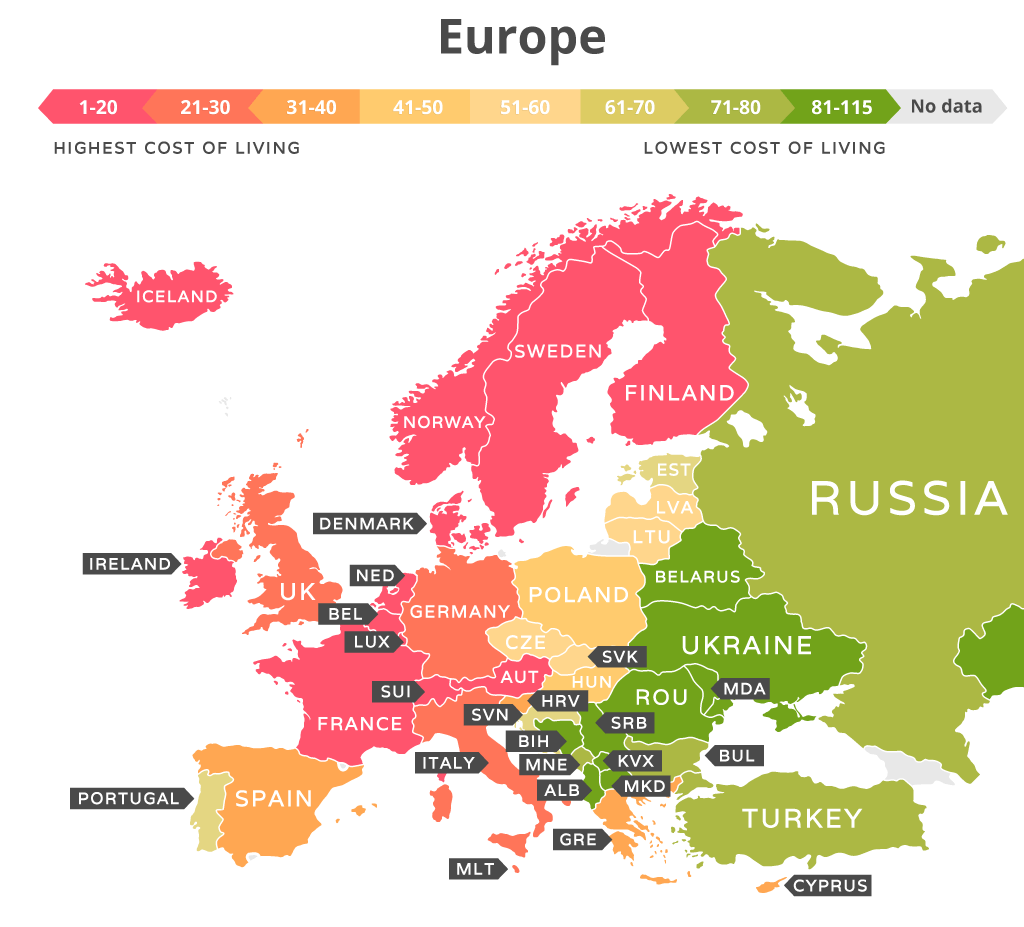

Household Budget Survey (HBS). Year 2024. Final Results. June 26, 2025. National Statistics Department.

Average household spending increased by 4.4% in 2024, reaching 34,044 euros. The average spending per person grew by 3.9% and was 13,626 euros. The groups with the highest increase in average household spending were Education Services and Recreational, sports, and cultural activities. The groups with the largest decrease were Alcoholic beverages and tobacco, and Furniture, household items, and routine household maintenance goods.

This tool provides a comprehensive overview of what you can expect to spend on a 90-square-meter apartment for two adults. Whether you’re curious about housing costs, utility bills, or dining out, this calculator will give you valuable insights to plan your future comfortably.

Spain cost of living calculator

Cost of Living by City

Cost of Living by Expense

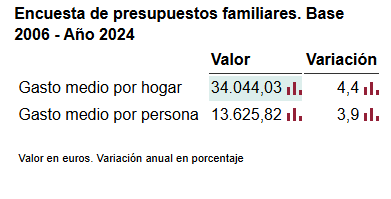

Southern Europe: Cost of Living by Country (2024)

| Country | Cost of Living Index |

|---|---|

| Italy | 58.9 |

| Malta | 55.1 |

| Greece | 54.2 |

| Slovenia | 49.3 |

| Spain | 48.4 |

| Croatia | 46.9 |

| Portugal | 46.6 |

| Montenegro | 40.9 |

Source: Numbeo Cost of Living Index by Country 2024

Cost of living

The cost of living refers to the total amount of money a person needs to spend to maintain a certain standard of living in a specific place. It includes all the basic expenses required for day-to-day life. Typically, it covers:

Housing – rent, mortgage, property taxes, utilities (electricity, water, heating).

Food – groceries, dining out, beverages.

Transportation – car payments, fuel, insurance, public transit costs.

Healthcare – insurance premiums, medical bills, medications.

Taxes – income tax, local taxes, and sometimes social security contributions.

Other necessities – clothing, personal care, communication (internet, phone).

Leisure and miscellaneous – entertainment, hobbies, travel.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.