Moving from Germany to Spain: Your Essential Guide

For many Germans, the dream of life in Spain is built on a foundation of sun-drenched coastlines, vibrant culture, and a more relaxed pace of life. Whether you’re a Rentner (pensioner) looking to stretch your pension, a Digitaler Nomade seeking a inspiring base, or a family wanting a new adventure, Spain offers a compelling new chapter.

The good news is that, as EU citizens, the move for Germans is more straightforward than for non-EU nationals. However, a successful relocation requires careful planning around bureaucracy, finances, and healthcare. This guide walks you through the key steps to turn your Spanish dream into a well-organised reality.

Residency: The Right to Live in Spain

As a German citizen, you have the right to live in Spain thanks to the EU freedom of movement. However, you must formally register your presence after three months.

- The First Step: The Certificado de Registro: Within the first three months of your move, you must apply for a green registration certificate (Certificado de Registro or Certificado de Ciudadano de la Unión) at your local foreigner’s office (Oficina de Extranjería or police station). This is your proof of legal residency.

- Permanent Residency: After living legally and continuously in Spain for five years, you can apply for permanent residency, which is not tied to any specific conditions.

ℹ️ Your Next Read: The application process requires specific documents. Our guide, Spain’s EU Residency: A Step-by-Step Guide, details the required paperwork, such as proof of comprehensive health insurance and sufficient financial means.

Navigating Healthcare: From German to Spanish Systems

Understanding how to transition from the German Krankenkasse (health insurance fund) to the Spanish system is crucial.

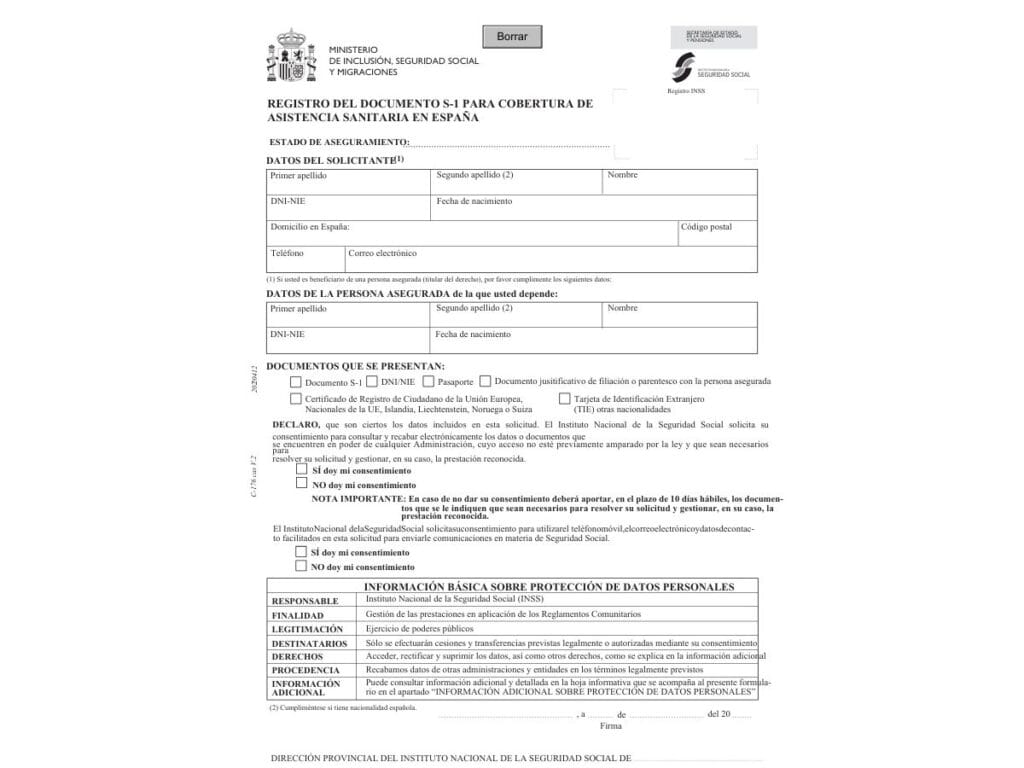

- If You are a Pensioner: If you receive a German state pension, you will likely be entitled to healthcare in Spain funded by Germany. This is done through the S1 Form (previously known as the E106/E121). You must request this from your German health insurer and register it with the Spanish social security office (Tesorería General de la Seguridad Social) to receive your Spanish health card (tarjeta sanitaria).

- If You are Employed or Self-Employed: If you work in Spain, you and your employer will contribute to the Spanish social security system, which grants you access to public healthcare.

- If You are Not Working (and not a pensioner): You must prove you have comprehensive private health insurance that meets Spanish requirements. This is a key condition for your residency certificate.

🏥 Go Deeper: The S1 process is vital for German retirees. Our article, The S1 Form in Spain: Healthcare for EU Pensioners, explains how to obtain and register your S1 to ensure seamless healthcare coverage.

👉 Planning a move in Europe?

Trust Univan for safe, efficient transport — request your free quote now.

*Ad – affiliate links. We may earn a commission.

Taxes and Finances: A German Perspective

As a Spanish resident, you will be subject to Spanish tax on your worldwide income. The Germany-Spain Double Taxation Treaty (Doppelbesteuerungsabkommen) prevents you from being taxed twice on the same income.

- German Pensions (Deutsche Rente): Your German state and private pensions are taxable in Spain. You will declare them on your annual Spanish tax return (Declaración de la Renta). The treaty determines which country has the primary right to tax.

- Wealth Tax & Reporting: Spain has an annual Impuesto sobre el Patrimonio (Wealth Tax). As a resident, you also have an obligation to declare overseas assets above a certain value using the Modelo 720 form. This is especially important if you maintain property or significant savings in Germany.

- Key Difference: Be aware of the Rentenbesteuerung (pension taxation) rules and how they interact with the Spanish IRPF (income tax) system. Professional advice is often recommended.

💶 Get Clarity: Financial planning is essential for a secure future. Our guide, Taxes for Expats in Spain: Understanding IRPF, Wealth Tax & Modelo 720, provides a clear breakdown of the system.

Posts for German Retirees

Building Your New Life in Spain

With the bureaucracy sorted, you can focus on the best part: enjoying your new home.

- Why Consider the North: While the Costas are popular, Northern Spain—from the green landscapes of Galicia to the cultural richness of the Basque Country—offers a stunning and often more temperate climate. It’s a hidden gem for those seeking authenticity and natural beauty.

- Senior Benefits: Spain offers excellent discounts for seniors (personas mayores). Once you have your residency and are over 65, you can access reduced fares on trains like Renfe, and discounts in shops, museums, and pharmacies.

🎉 Enjoy the Perks: Make your Rente go further. Discover all the ways to save with our popular guide, Senior Discounts in Spain: Saving on Transport, Food, and Culture.

Häufig Gestellte Fragen (Frequently Asked Questions)

Ihr spanisches Abenteuer beginnt hier

Moving countries is a big step, but with the right information, it is an incredibly rewarding one. This guide is your foundation. Use the resources linked throughout to build your knowledge and confidence.

Wir wünschen Ihnen viel Erfolg bei Ihrem neuen Leben in Spanien! (We wish you every success in your new life in Spain