Moving from the UK to Spain Post-Brexit Guide

Dreaming of swapping the British rain for Spanish sunshine? You’re not alone. For decades, the UK’s love affair with Spain has made it a top destination for retirees, remote workers, and families seeking a new life. However, since Brexit, the rules have changed. Moving from the UK to Spain now requires more planning and a clear understanding of new immigration, healthcare, and tax regulations.

But don’t let that daunt you. With the right information, your transition can be smooth and successful. This guide is your one-stop resource, walking you through every critical step—from visa applications and healthcare registration to understanding your tax obligations and settling into your new community.

Residency & Visas: The New Foundation

Your first and most important step is securing the right to live in Spain. The days of unrestricted movement are over, and applying for a visa before you move is now mandatory.

- The Non-Lucrative Visa: This is the most common route for retirees and those with sufficient savings. It requires you to prove a stable, passive income that meets a specific annual minimum (which is reviewed yearly) without needing to work in Spain.

- The Digital Nomad Visa: Officially known as the International Telework Visa, this is perfect if you work remotely for a company based outside of Spain or run your own online business. It offers a faster route to permanent residency and favourable tax benefits.

📄 Your Next Read: Choosing the right visa is critical.

Spain’s Non-Lucrative Visa 2024: Requirements, Income & Application

Confused by the options? Our complete guide to Spanish residency visas breaks down the requirements, documents, and process.

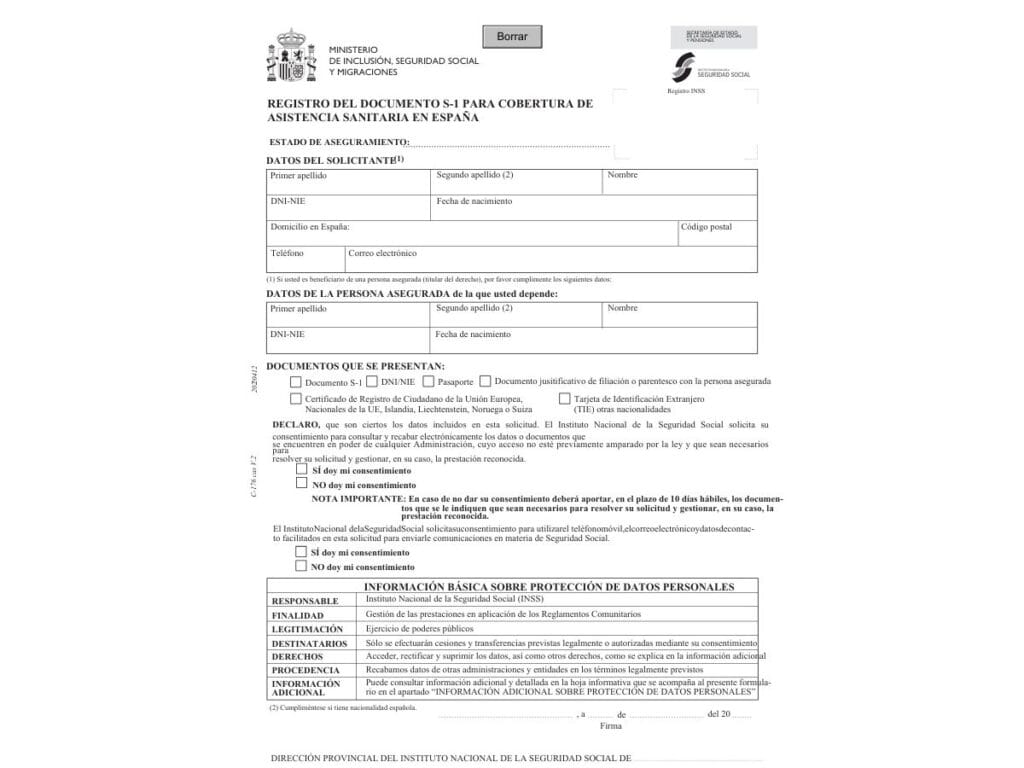

Navigating Healthcare: The S1 Form and Beyond

Understanding healthcare is arguably the most significant change for UK nationals. You are no longer covered by the EU’s reciprocal healthcare agreements. Instead, the process now largely revolves around the S1 Form.

The cornerstone of healthcare for most UK pensioners is now the S1 Form.

- What is the S1? If you receive a UK State Pension, you can apply for an S1 certificate. This registers you with the Spanish healthcare system, with the UK covering your healthcare costs.

- The Registration Process: You must register your S1 with your local Spanish social security office (Tesorería General de la Seguridad Social). This is a crucial step to get your Spanish health card (tarjeta sanitaria).

- If You’re Not a Pensioner: Those under the State Pension age will need to prove they have comprehensive private health insurance that meets Spanish government requirements as part of their visa application. You may be able to join the public system later via work (convenio especial).

🏥 Go Deeper: The S1 process can be complex.

The UK S1 Form for Spain: A Step-by-Step 2024 Guide

S1 For for NLV Health Insurance

The S1 process can be complex. Our step-by-step S1 guide helps you navigate the application and registration seamlessly.

Posts for UK Nationals

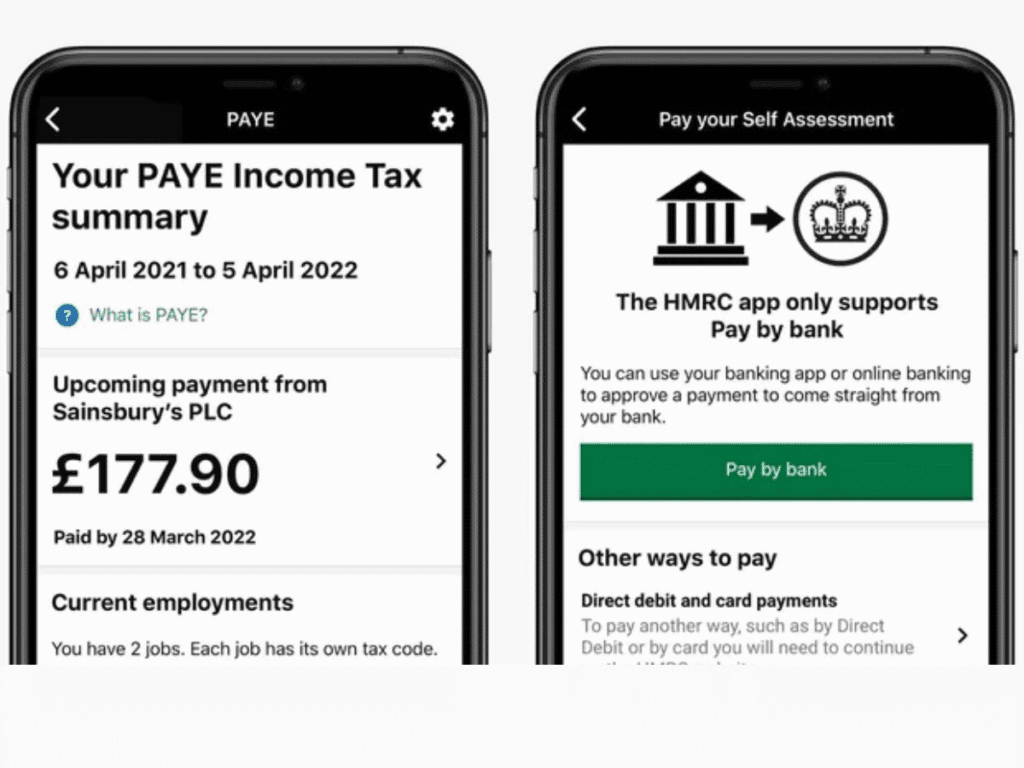

Taxes and Finances: Planning is Key

As a Spanish resident, you will be subject to Spanish tax on your worldwide income. This includes your UK state and private pensions, rental income, and investment returns. Understanding the difference between non-resident tax (IRNR) when you first arrive and resident tax (IRPF) is crucial.

- UK Pensions: Your UK state and private pensions are taxable in Spain. You’ll declare them on your annual Spanish tax return (Declaración de la Renta).

- IRNR vs. IRPF: When you first arrive (before residency), you may pay Non-Resident Income Tax (IRNR). Once you are officially resident, you’ll switch to Personal Income Tax (IRPF). Understanding the difference is key.

- Wealth Tax & Reporting: Spain has an annual Wealth Tax (Impuesto sobre el Patrimonio) for assets over a high threshold. You also have an obligation to declare overseas assets above a certain value (Modelo 720).

💷 Get Clarity: Financial planning is essential.

UK & Spanish Tax Treaty: What You Need to Know

Get the clarity you need on your financial obligations with our simple guide to taxes for expats.

👉 Planning a move in Europe?

Trust Univan for safe, efficient transport — request your free quote now.

*Ad – affiliate links. We may earn a commission.

Building Your New Life in Spain

Once the paperwork is sorted, the real fun begins! Spain offers an incredible quality of life, but a smooth transition involves practical steps. From finding a home and opening a bank account to understanding local customs and finding your community, these details make Spain feel like home.

- Find Your Community: Northern Spain, from the Basque Country to Cantabria and Asturias, offers a stunning and authentic alternative to the costas. Explore our regional guides to find your perfect spot.

- Save Money as a Senior: One of the joys of life in Spain is the culture of valuing its seniors. You can access fantastic discounts on transport like Renfe trains, cultural activities, and in supermarkets like Carrefour once you have your residency and proof of age.

🎉 Enjoy the Perks: Make your pension go further. Discover all the ways to save with our popular guide

Senior Discounts in Spain: How to Save on Travel, Food & Fun

Discover all the ways you can enjoy your retirement budget further with our guide to senior discounts.

Frequently Asked Questions (FAQ)

Your Spanish Adventure Awaits

Moving country is a significant undertaking, but with meticulous preparation, it can be one of the most rewarding decisions you’ll ever make. This guide is your starting point. Use the resources linked throughout to dive deeper into each topic, and remember, you’re building a new life in one of the world’s most vibrant and welcoming countries.

¡Bienvenidos a España! Your new chapter starts now.