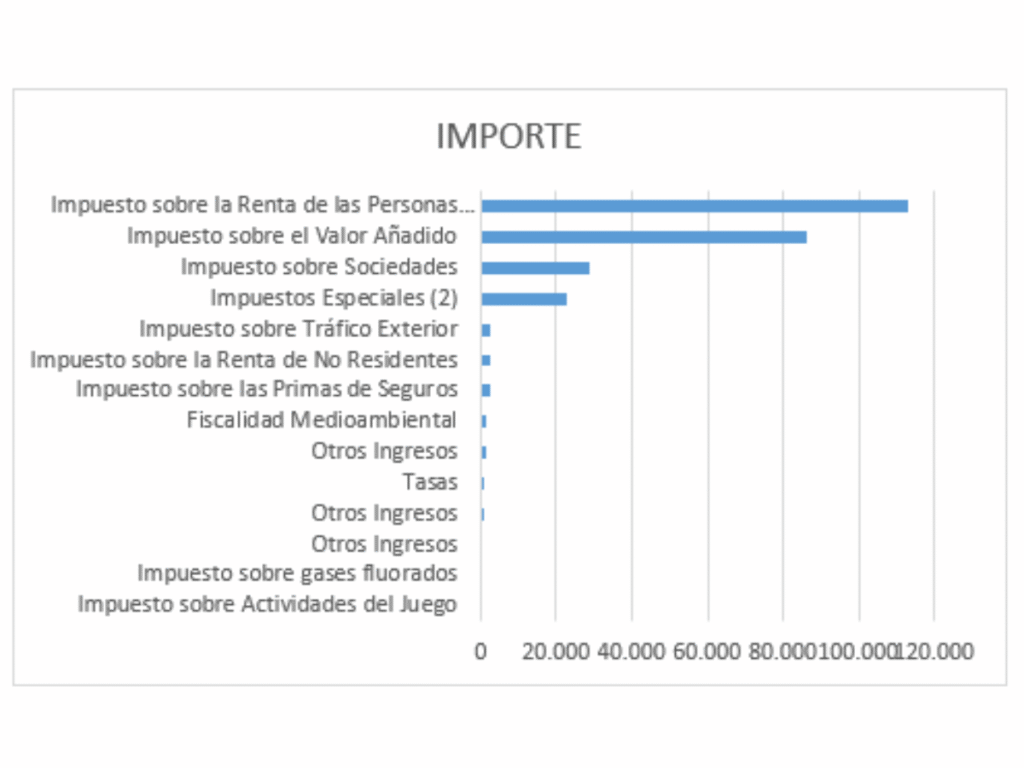

The Broader Spanish Tax Landscape

While Personal Income Tax (IRPF) and Value Added Tax (VAT) form the bedrock of Spain’s fiscal structure, the country’s tax system extends into a complex, yet critical, landscape of “other taxes.” These levies are particularly significant for high-net-worth individuals and for the inter-generational transfer of wealth.

The Spanish system is notably decentralized, granting substantial legislative powers to its Autonomous Communities (regions) to regulate key aspects—such as exemptions, allowances, and rates—for Wealth Tax and Inheritance & Gift Tax. This regional variance creates a patchwork of regulations that can lead to dramatically different tax outcomes depending on where a resident is fiscally domiciled.

This introduction will explore three of the most significant “other taxes” in Spain: the Wealth Tax (Impuesto sobre el Patrimonio, IP), the Temporary Solidarity Tax on Large Fortunes (ITSGF), and the Inheritance & Gift Tax (Impuesto sobre Sucesiones y Donaciones, ISD). Crucially, the focus here is on the tax liability for residents in Spain, as the distinct and generally more straightforward rules for non-residents (like a non-resident British person owning a holiday apartment) are covered separately.

💰 Wealth Tax (Impuesto sobre el Patrimonio – IP)

The Wealth Tax is an annual levy on the net value of a taxpayer’s personal assets as of December 31st each year. It is a recurring tax on accumulated wealth, calculated on the total value of assets (including real estate, investments, bank deposits, and certain luxury goods) minus debts and liabilities.

Key Aspects for Spanish Residents

For Spanish tax residents, the Wealth Tax applies to their worldwide net assets. This principle of worldwide taxation means residents must declare everything they own globally, not just assets held within Spain.

- Exemptions and Allowances:

- General Exemption: A standard national tax-free allowance of €700,000 applies to each individual’s net wealth. However, Autonomous Communities have the power to alter this, and some, like Catalonia, have established a lower threshold.

- Main Residence Exemption: An additional exemption of up to €300,000 is available for the taxpayer’s principal private residence.

- Business Assets: Shares in family companies or business assets may also benefit from significant exemptions, provided strict legal requirements regarding ownership and management are met.

- Regional Divergence: The most defining feature of the Wealth Tax is the power of the Autonomous Communities to set their own rates and, most significantly, their own tax reliefs.

- Historically, regions like Madrid and Andalusia have offered a 100% relief (or bonus), effectively reducing the Wealth Tax liability for residents to zero, regardless of their net worth (though this is now superseded by the ITSGF for the wealthiest individuals).

- Conversely, other regions, such as Catalonia and the Balearic Islands, maintain a progressive tax scale, with rates ranging from approximately 0.2% up to 3.5% (state scale).

- Taxation Mechanism: The tax operates on a progressive scale, meaning the tax rate increases as the net wealth rises. The final tax liability for a resident is calculated using the progressive national or regional scale, applied to the taxable base (net wealth minus exemptions). The Autonomous Community of residence determines which regional rules apply.

Non-Residents Wealth Tax

Only charges and encumbrances affecting assets and rights which are located in Spanish territory or which may be exercised or have to be fulfilled in Spain, as well as debts for capital invested in the aforementioned assets, shall be deductible.

👑 Temporary Solidarity Tax on Large Fortunes (ITSGF)

Introduced as a state-level response to regional tax competition—specifically, the 100% reliefs offered by some Autonomous Communities—the ITSGF is a temporary, complementary wealth tax. It is explicitly designed to ensure that the wealthiest individuals across Spain contribute a minimum amount of tax on their assets.

Interaction with Wealth Tax (IP)

The ITSGF is effectively a ‘top-up’ tax. The amount of Wealth Tax (IP) actually paid to the Autonomous Community is deductible from the ITSGF liability.

- Threshold and Scope: The ITSGF is levied on individuals with worldwide net wealth exceeding €3,000,000. Due to the €700,000 personal allowance, a resident without a main residence exemption would effectively begin paying this tax on net assets over €3,700,000.

- Applicability for Residents: For residents in Autonomous Communities that impose a significant Wealth Tax (e.g., Catalonia), the ITSGF liability is typically zero because the IP paid to the region is equal to or greater than the Solidarity Tax due. However, for residents in regions with a 100% Wealth Tax relief (like Madrid), the ITSGF becomes the primary wealth tax mechanism, ensuring high-net-worth residents pay the state a tax based on the ITSGF rates.

🎁 Inheritance & Gift Tax (Impuesto sobre Sucesiones y Donaciones – ISD)

The Inheritance and Gift Tax is levied on the recipient (the heir or the donee) of assets transferred upon death (inheritance) or during a lifetime (gift). Like the Wealth Tax, this is one of the most regionally differentiated taxes in Spain.

Key Aspects for Spanish Residents

For a Spanish tax resident, the tax applies to all assets inherited or received as a gift, regardless of where those assets are located in the world (the principle of worldwide obligation).

- Taxable Event: The tax is triggered by an acquisition of goods or rights:

- Mortis Causa (Inheritance): Acquisition due to death.

- Inter Vivos (Gift/Donation): Acquisition as a lifetime gift.

- Tax Base and Rates: The calculation is highly complex, involving:

- Progressive Tax Rates: A national scale ranging from 7.65% to 34%.

- Multiplier Coefficients: These coefficients, based on the degree of kinship and the heir’s pre-existing wealth, can significantly multiply the final tax due. Close relatives are divided into Groups I (children under 21) and II (spouses, older children, parents), who benefit from the lowest multipliers.

- Allowances and Reductions: All recipients benefit from state allowances based on their kinship group, which Autonomous Communities can—and often do—enhance dramatically.

- Regional Autonomy: The Game Changer: The power of the Autonomous Communities to set their own reductions and allowances is the most critical element.

- Many regions, including Madrid, Andalusia, and Valencia, have established bonuses or reliefs of 99% or more for transfers between spouses, children, and parents (Groups I and II). In these regions, a close family member may pay little to no Inheritance or Gift Tax.

- Conversely, other regions may offer lower reliefs, making the tax burden for the same inheritance or gift substantially higher.

Non-Residents

You must present a different Self-Assessment Form (650, 651 or 655) depending on whether it is a succession, a donation or the extinction of a usufruct

- 650 Form: Acquisition of property and rights by inheritance, bequest or any other succession, and receipt of amounts by beneficiaries of life insurance contracts, when the contracting party is a person other than the beneficiary.

Who is obliged to file it: Heirs, legatees or beneficiaries of a life insurance policy (individuals) who do not have their principal residence in Spain, or residents who acquire assets, or are beneficiaries of a life insurance policy, of a deceased person, who did not have their tax residence in Spain.

- 651 Form: Acquisition of goods and rights by donation or any other legal transaction free of charge, inter vivos

Who is obliged to file it: Natural persons who do not have their residence in Spanish territory for the assets and rights that were located, had to be fulfilled or could be exercised in Spanish territory that they acquire by donation or any other legal transaction free of charge and inter vivos.

Resident natural persons who acquire real estate located abroad by donation or any other legal transaction free of charge and inter vivos are also eligible.

- 655 Form: Consolidation of ownership in the person of the bare owner as a result of the extinction of a usufruct constituted through a lucrative transfer (succession or donation)

Who is obliged to file it: The owners who consolidate the domain as a consequence of the extinction of the usufruct.

🎯 Conclusion for Residents

For individuals who are tax residents in Spain, the “other taxes” are characterized by two overarching principles: worldwide taxation and radical regional differentiation. Unlike non-residents, who are only taxed on Spanish-situs assets, a resident’s global wealth and all inherited or gifted assets are brought into the Spanish tax net.

However, the final tax liability is critically dependent on the Autonomous Community of residence, which dictates the effective rate of Wealth Tax, the ultimate impact of the Solidarity Tax, and the amount of Inheritance and Gift Tax a close family member may face. Tax planning in Spain, therefore, begins not just with understanding the tax law, but with determining which regional regulations apply.

Taxes Related To Housing

There are two main expenses, one related to purchising a house, and another a annual tax.

Annual Council Tax on Properties

Impuesto sobre Bienes Inmuebles aka Contribución: The amount vary from city to city. For a 90 square metres apartment it can range from 150 EUR in mid-size cities to 500 EUR in big cities.

Taxes when purchising a house and mortgage

You can see these taxes in the dedicated page.

Taxes Related To Cars

Buying a car

In the same way than when buying a house, you may have to pay one out these two taxes:

- VAT: in the case that the car is brand new

- ITP: in the case the car is second hand

Annual car tax

You have to pay “Impuesto de circulación” to the City Council, which may vary from city to city, to an average of 60 EUR for a mid-size car.