Understanding the Taxation of Your Pension

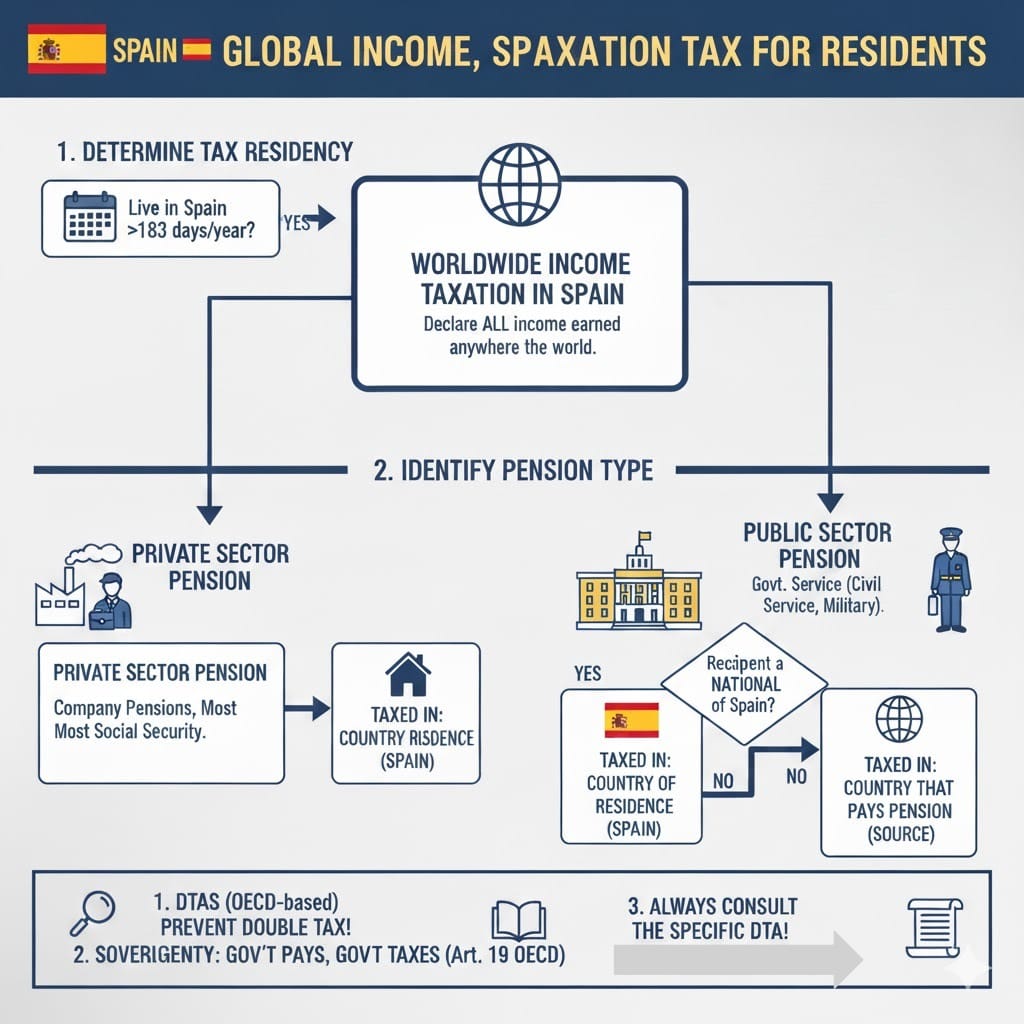

The tax treatment of your pension in Spain depends heavily on whether it originates from previous employment in the private or public sector. Spain’s double taxation treaties, which all follow the OECD Model Tax Convention, provide specific rules to determine which country has the right to tax this income.

The Crucial Impact of Spanish Tax Residency

Once a foreigner becomes a Spanish tax resident (liable for Personal Income Tax – IRPF), they are subject to Worldwide Income Taxation. This means they must declare all their income, including pensions, earned anywhere in the world, to the Spanish tax authorities.

The Core Rule: Worldwide Taxation

| Status | Tax Obligation in Spain |

| Non-Resident (Less than 183 days) | Only taxed on income sourced in Spain. |

| Tax Resident (183+ days, etc.) | Taxed on Worldwide Income (including all foreign pensions). |

Double Taxation Agreements (DTAs) Become Essential

Since Spain taxes worldwide income, the potential for double taxation (being taxed on the same income in Spain and the country of origin) is high. This is where the DTAs become critical. The DTA rules you cited determine which country has the primary right to tax a specific pension:

The general principles are summarized in the table below:

| Type of Pension | Standard Taxing Right | Key Condition / Exception |

|---|---|---|

| Private Sector Pensions (e.g., from a private company, or Social Security) | Country of Residence of the pension recipient | This is the most common rule, with limited exceptions. |

| Public Sector Pensions (e.g., for civil servants, military) | Country that pays the pension (the source country) | Exception: If the recipient is a national of their country of residence, that country may have the taxing right. |

🌎Detailed Breakdown

Private Sector Pensions

This category includes pensions from private companies and most pensions paid by the general social security system.

- General Rule: The right to tax these pensions almost always belongs to the country where the pensioner resides.

- Practical Implication: If you are a tax resident in Spain, you will typically declare and pay tax on your private or social security pension in Spain, regardless of which country pays it.

Public Sector Pensions

This refers to pensions resulting from dependent work for the state, a political subdivision, or a local authority (e.g., federal/national government, regional government, municipality).

- General Rule: The right to tax is typically reserved for the country that pays the pension (the source country).

- Important Exception: Many treaties include a provision that shifts the taxing right to your country of residence if you are a national of that country. The application of this exception can be complex.

The following table illustrates how these rules might apply to a public sector pension:

| Scenario | Taxing Right |

|---|---|

| A French national receives a Spanish civil service pension while living in France. | Spain (Source country rule applies). |

| A Spanish national receives a Spanish civil service pension while living in Portugal. | Portugal may have the right to tax if the Spain-Portugal treaty grants taxing rights to the country of residence for its own nationals. |

🏛️ Public Sector Pension Exceptions

The general rule for public sector pensions has an important exception in some treaties:

| Condition | Tax Jurisdiction |

| The recipient of the public sector pension is also a national of the State of Residence. | The State of Residence gains the tax jurisdiction. |

| The recipient is not a national of the State of Residence. | The State of Origin retains the tax jurisdiction. |

The Core Principle: “Government Service” and Fiscal Sovereignty

The reason lies in Article 19 of the OECD Model Tax Convention, which deals with “Remuneration and Pensions in respect of Government Service.” This article creates an exception to the general rules.

The underlying logic is one of fiscal sovereignty and reciprocity:

- Sovereign Immunity & Fiscal Priority: A country believes that the cost of its government—including the pensions it pays to its former civil servants, military personnel, and other public officials—should be borne by its own treasury and tax system. It is a matter of national sovereignty. Allowing another country to tax these payments is seen as ceding fiscal authority over its own state apparatus.

- Reciprocity: This is a reciprocal agreement between states. Spain agrees that France can tax its former French civil servants living in Spain, and in return, France agrees that Spain can tax its former Spanish civil servants living in France.

Important Note !

All double taxation treaties signed by Spain follow the OECD Model Tax Convention. The OECD stands for the Organisation for Economic Co-operation and Development.

While this provides a consistent framework, the specific wording in each bilateral treaty can vary. It is crucial to consult the exact treaty between Spain and the other relevant country for a definitive determination of your tax liabilities

✅ In Summary

- After 183 days, you’re a Spanish tax resident → Spain taxes your worldwide income.

- Private pensions → taxed in Spain.

- Public pensions → usually taxed in the country that pays them.

- Always check the double taxation treaty between Spain and your home country to confirm your case.

Pensions in OECD Convention Model

The MCOECD dedicates two articles to pensions based on whether they are public or private. It should be noted that the concept of public or private for these purposes differs from the generally understood definition.

A pension is considered private when the right to receive it arises from having worked for a private employer, and public if the employer was a public entity. It is evident that the relevance is not in the nature of the payer of the pension, but rather in the nature of the employment that now gives rise to the pension.

For example, benefits paid by Social Security to a person who worked for a private company are considered private under the MCOCDE and are regulated by Article 18. However, if there were no treaty, these would be considered public since they are paid by a public entity.

Article 18 establishes that, for private pensions paid to a resident of a contracting state for previous dependent work, they can only be taxed in that state. Therefore, the exclusive taxing rights rest with the state of residence of the recipient.

Article 19, which regulates “Public Functions,” dedicates section 2 to “public pensions.” In this case, the exclusive taxing right generally belongs to the paying state. However, there may be an exception if the recipient is a national and resident of the non-paying state, in which case the taxing right will belong to the state of residence.

Example

Jochen, a retired German national residing in Mallorca, has two sources of income from two separate pensions:

- A pension of 2,000 euros per month. This pension derives from work performed as a engineer for a private company.

- PRIVATE PENSION: Provision 18, Taxed in Spain

- A pension of 1,00 euros per month corresponding to work as a civil servant.

- PUBLIC PENSION; Provision 19, Taxed in Germany, unless Spanish citizenship.

⭐Pensions Non-Residents, in IRNR

Article 13.1.d establishes that pensions and other similar benefits received by a non-resident are considered to be obtained in Spanish territory when they arise from employment carried out in Spain or when they are paid by a resident or an establishment located in Spain.

Pensions are defined as remuneration paid for previous employment, regardless of whether they are received by the worker themselves or another person.

Examples of similar benefits are found in Articles 17.2.a) and f) of the LIRPF: mutual funds for civil servants, pension funds for retired officials, compensatory pensions, and alimony payments.

The taxable base is the full amount, and the tax rate is determined by applying a scale ranging from 8% to 40%.

Pension Taxation Scale

| Annual Pension Amount (up to euros) | Fee (euros) | Rest of Pension (up to euros) | Applicable Rate (%) |

|---|---|---|---|

| 0 | 0 | 12,000 | 8% |

| 12,000 | 960 | 6,700 | 30% |

| 18,700 | 2,970 | above | 40% |

Why It Matters for Retirees

| Reason | Importance |

|---|---|

| Avoid Double Taxation | Knowing which country can tax your pension helps you claim foreign tax credits or exemptions. |

| Planning Your Move | Understanding this before you relocate helps estimate your net income after Spanish taxes. |

| Compliance | Spanish tax authorities require residents to declare all foreign income and foreign assets (Modelo 720). |

| Financial Optimization | With good planning, you may benefit from tax-efficient pension transfers or treaty advantages. |