The Silver Economy in Spain: An Economic Engine of the Future

The global demographic shift toward an aging population presents one of the most significant socio-economic transformations of our time. In Spain, this phenomenon—often referred to as the “Silver Economy” (Economía Plateada)—is particularly pronounced, creating both societal challenges and massive market opportunities.

Defining the Silver Economy

The Silver Economy encompasses all economic activities, including the production, consumption, trade of goods, and provision of services, that cater to the needs and demands of the aging population.

Age Range: While definitions vary slightly, the Silver Economy generally includes individuals aged 50 and above. This large segment is often split into:

- “Young” Seniors (50-65/70): Still active in the labor market or newly retired, possessing significant disposable income, high purchasing power, and a focus on health, travel, leisure, and technology adoption.

- Older Seniors (70+): With increasing needs for healthcare, long-term care, adapted housing, and social support.

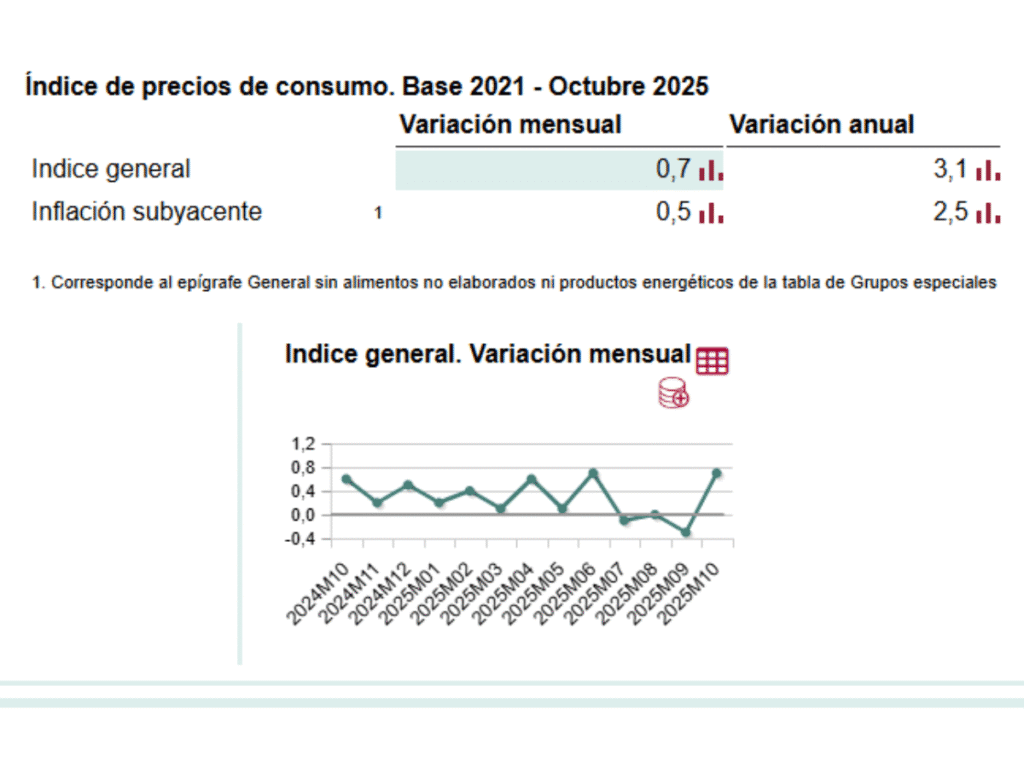

📈 Spain’s Demographic Landscape and Western Trends

Spain presents a textbook case of rapid demographic aging, a trend mirrored across Western Europe and Japan.

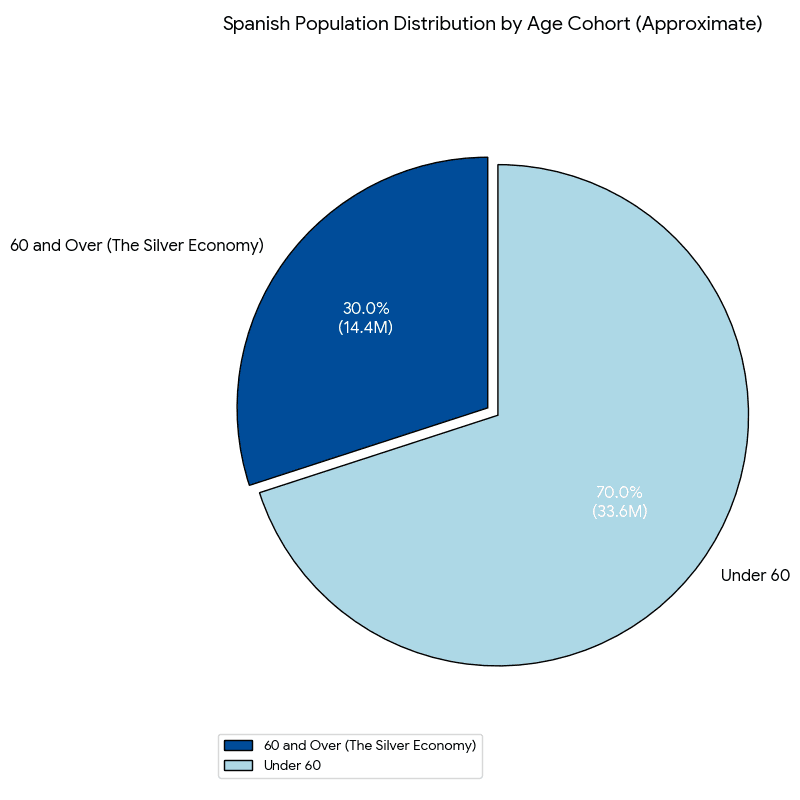

Current Population: Spain has a population of approximately 48 million people.

The Aging Bulk: Over 12.5 million people are aged 65 or over, representing more than 25% of the population. Those over 60 constitute an even larger share, nearing 30%.

- The Birth Rate Crisis: Compounding this, Spain has one of the lowest birth rates in the world, at around 1.19 children per woman, far below the replacement rate of 2.1.

- Future Projections: The outlook is clear. By 2050, it is projected that people over 65 will make up over 35% of the Spanish population, while the number of centenarians is expected to multiply significantly. This inverted age pyramid poses significant challenges for sustainability, from pension systems to healthcare.

This situation is not unique to Spain. Nations like Italy, Germany, and Portugal face similar, if not more acute, challenges. The “Western” model of a growing, young workforce supporting a small retired class is rapidly becoming obsolete.

💰 The Economic Power of the Senior Population

The perception of seniors as solely recipients of public spending is rapidly changing, revealing their immense economic power as consumers and wealth holders.

- Wealth and Savings: Seniors in the 50+ age bracket in Spain often have higher average wealth and purchasing power than younger cohorts, having paid off mortgages, completed family expenses, and accumulated savings. For instance, the average income per person for the $65+$ group can be higher than the $30-45$ group.

- Contribution to GDP and Expenditure: In the European Union, the consumer expenditure of the $50+$ population is substantial, estimated to be several trillion euros and contributing significantly to the EU’s Gross Domestic Product (GDP). Spain’s senior expenditure mirrors this trend, driving sectors like tourism (crucial for seasonal adjustment), leisure, and health.

- Public Spending Impact: While seniors are major consumers, the aging process also significantly increases public expenditure on services. In Spain, public spending related to aging (pensions, healthcare, and long-term care) was $\approx 20.3\%$ of GDP in 2022 and is projected to rise to $\approx 25.5\%$ of GDP by 2050. Pension expenditure alone represents the largest share, highlighting the economic scale of this demographic.

🏛️ The Role of Public Administration

Public administration acts as a fundamental engine and contractor for the Silver Economy, driven by its mandate to ensure the welfare, health, and social inclusion of its older citizens.

- Provider and Regulator: The government’s primary role is as the main funder and organizer of Long-Term Care (LTC) services, healthcare, and state pensions. This involves setting regulatory frameworks for service quality and eligibility.

- Key Contractor: In Spain’s welfare model, public funds are frequently used to contract with the private and non-profit sectors for service delivery. This includes:

- Dependence Services: Contracting for home care (Ayuda a Domicilio), day centers, and residential care homes.

- Health Services: Purchasing specialized medical equipment, telecare services, and preventative health programs.

- Innovation Investment: Governments are increasingly investing in gerontechnology and digital solutions (e.g., smart homes, teleassistance) to promote active and healthy aging, which creates new public-private partnership opportunities.

🧑🦳 Services for the “Third and Fourth Age”

The Silver Economy differentiates its offerings to meet the distinct needs of the two main senior cohorts in Spain: tercera edad and cuarta edad.

Tercera Edad (Third Age – Early Retirement/Active Seniors): This group is generally autonomous, active, and focused on active aging. The Silver Economy provides:

- Active Leisure and Tourism: Customized and accessible travel packages (IMSERSO programs, active cultural and sports holidays).

- Education and Lifelong Learning: University programs for seniors and digital literacy courses.

- Adapted Housing: “Smart home” solutions, retirement communities, and services focused on home adaptation to remain independent.

- Financial Products: Specialized savings, investment, and retirement planning.

Cuarta Edad (Fourth Age – Advanced Age/Special Needs): This group consists of older people with special needs, often facing dependency or chronic health conditions. The focus shifts to care and support:

- Long-Term Care (LTC): Residential facilities, specialized medical services, and palliative care.

- Telecare and eHealth: Remote monitoring, emergency response systems, and digital health management to support aging in place.

- Personalized Home Services: Advanced home care (Ayuda a Domicilio) that includes not just basic care but also rehabilitation and social support to combat loneliness.

🚀 Other Interesting Topics: Digital Divide and Social Inclusion

One critical area for the Spanish Silver Economy is addressing the digital divide and ensuring social inclusion.

- Bridging the Digital Divide: Despite the 50-70 age group’s increasing use of technology, older seniors face barriers to accessing online services, managing their finances, and maintaining social connections. The Silver Economy is driving the development of user-friendly, simplified technology (Gerontechnology) and public programs to teach digital skills, a vital step for accessing key services like banking and public administration.

- Combating Unwanted Loneliness: Social isolation is a significant public health issue. The Silver Economy creates market solutions, often in partnership with public entities, such as community transport, shared social spaces, intergenerational programs, and technology-based social connection tools to ensure seniors remain engaged and connected to society.