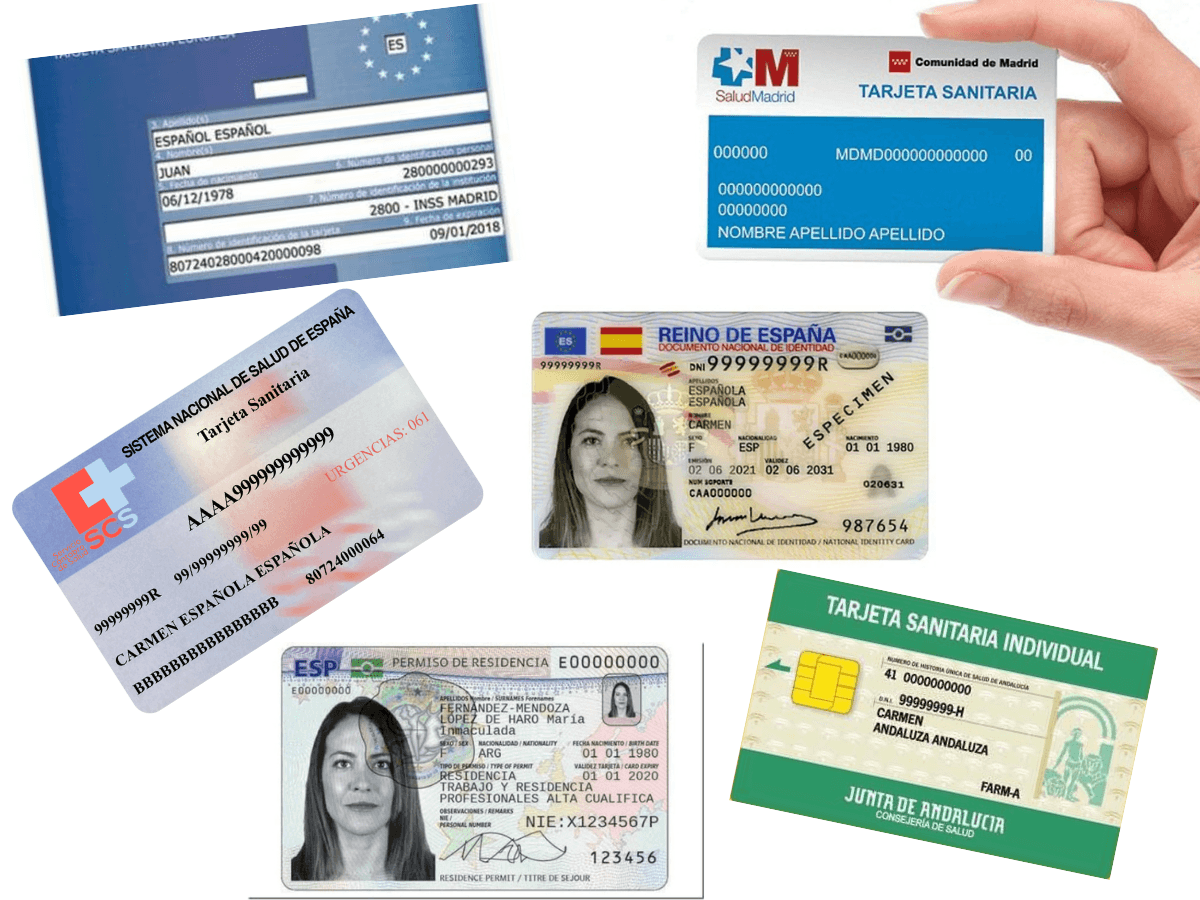

Spanish Official Card You Will Need TIE

Navigating Spanish life comes with a few essential official cards and documents that are your keys to a smooth and legal experience. It can seem like a alphabet soup of acronyms—NIE, TIE, TSE—but each one has a specific purpose.

Think of this as your starter kit. Below, we break down each card you’ll need, from your fundamental tax number to your European health insurance, explaining what it is, when you’ll get it, and why it’s non-negotiable.

Let’s demystify the paperwork together.

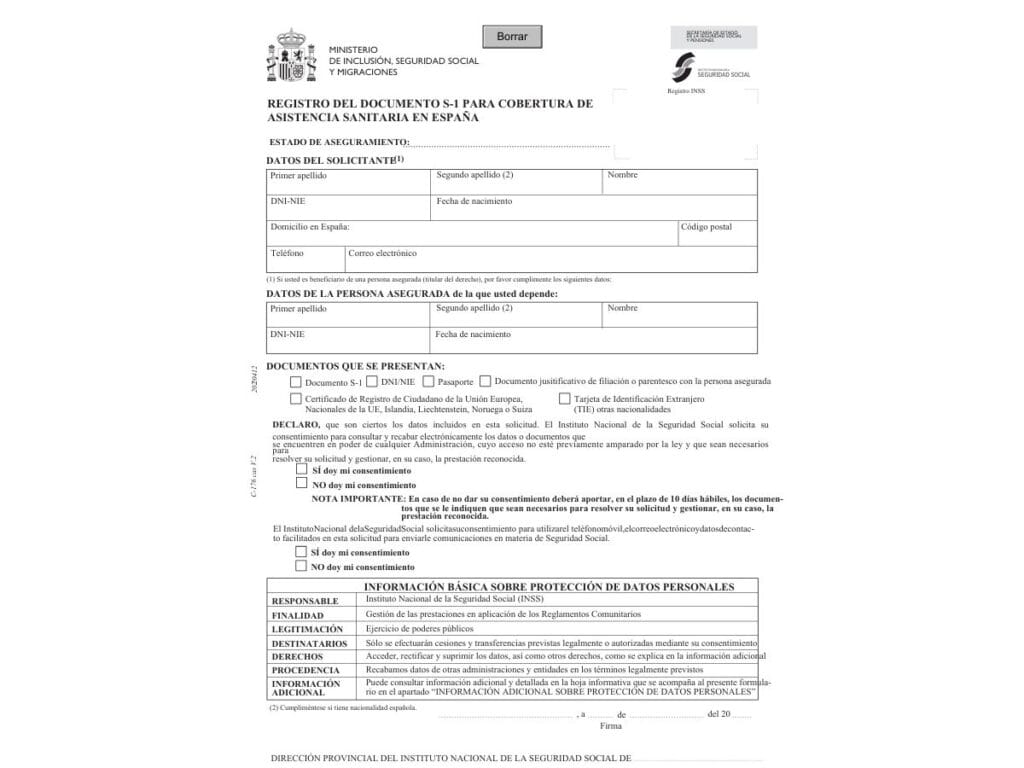

1. NIE Certificate (Número de Identidad de Extranjero)

- What it is: A green paper form assigning your tax ID number. Your key number for life in Spain.

- When: Before or just after arriving.

- Why: Essential for banks, contracts, bureaucracy.

- Visual: Green paper document.

2. TIE Card (Tarjeta de Identidad de Extranjero)

- What it is: The physical photo ID for non-EU residents.

- When: After you arrive with your visa.

- Why: Your official proof of legal residency.

- Visual: The actual green TIE card.

Key Distinction DNI vs. TIE

DNI: The national ID card for Spanish citizens.

TIE: The residency card for non-EU foreigners living in Spain.

Key Distinction DNI vs. NIF – IDs for Spanish Citizens

It’s helpful to understand these IDs, as you will hear these terms often, even though they are for Spanish nationals.

DNI (Documento Nacional de Identidad)

- What it is: The official national identity card for Spanish citizens. It’s their primary photo ID, similar to a national ID card in other countries.

- Who it’s for: Spanish citizens only.

- Key Fact: As a foreign retiree, you will not get a DNI. Your equivalent is the TIE card.

NIF (Número de Identificación Fiscal)

- What it is: The official tax identification number for legal and financial transactions.

- Who it’s for:

- For a Spanish citizen, their NIF is the same number as their DNI.

- For a foreign resident, your NIF is the same as your NIE number. You use your NIE for all tax purposes.

- The Simple Rule: Think of NIF as the “job title” for a tax ID. A Spanish citizen’s tax ID (NIF) is their DNI number. Your tax ID (NIF) is your NIE number.

How It All Fits Together:

| If you are a… | Your Photo ID Card is… | Your Tax ID Number (NIF) is… |

|---|---|---|

| Spanish Citizen | DNI | Your DNI number |

| Non-EU Retiree | TIE | Your NIE number |