Core Spanish Tax Principles for Retirees

The taxation of retirees moving to Spain from countries like the USA, UK, Germany, and France is fundamentally governed by Spanish tax residency rules and is then modified by the specific Double Taxation Treaty (DTT) Spain has with each country.

The crucial first step for any retiree is determining their Spanish tax residence status, as this dictates whether they are taxed on their worldwide income (as a resident) or only on their Spanish-sourced income (as a non-resident).

Tax Residency

You are generally considered a Spanish Tax Resident if you meet any of the following criteria in a given calendar year:

- You spend more than 183 days (physical presence) in Spain. Temporary absences are counted toward the 183 days unless you can prove tax residence in another country.

- Your main center of economic interests (where most of your income/assets are located) is in Spain.

- Your “center of vital interests” (spouse and/or dependent children reside) is in Spain.

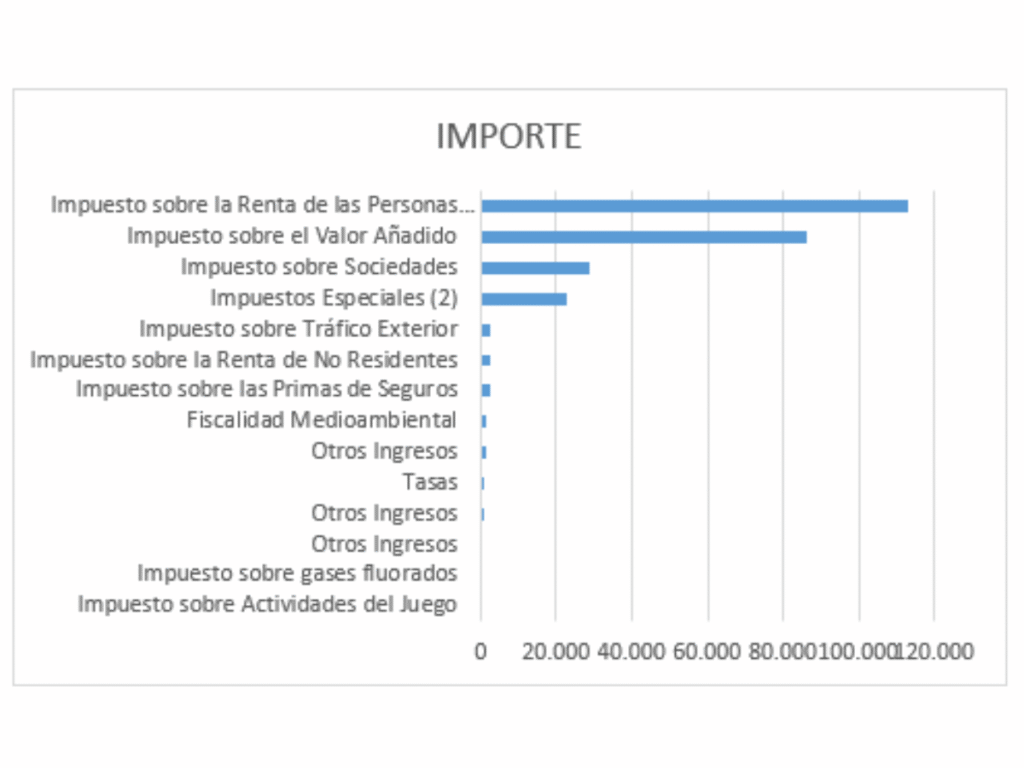

Main Taxes

- Personal Income Tax (IRPF): Tax residents are taxed on their worldwide income at progressive scale rates (combining state and regional rates, which vary by Autonomous Community). Income is generally divided into General Income (e.g., pensions, salaries) and Savings Income (e.g., interest, dividends, capital gains).

- Wealth Tax: This annual tax is levied on a resident’s worldwide net assets above certain thresholds (€700,000 national minimum exemption, though this varies significantly by region). Non-residents are only taxed on assets located in Spain. A temporary Solidarity Tax on Large Fortunes may also apply to net assets over €3,000,000.

- Modelo 720: Spanish tax residents must declare all overseas assets (bank accounts, investments, real estate) if the value in a specific category exceeds €50,000. Failure to file or incorrect filing carries severe penalties.

🌐 The Role of Double Taxation Treaties (DTTs)

Spain has a DTT with the USA, UK, Germany, and France. The primary purpose of a DTT is to prevent the same income from being taxed in both countries and to establish which country has the primary taxing right for specific income types, such as pensions. This is crucial for retirement planning.

Key DTT Variations for Retirement Income

| Country | Key DTT Principle (Pensions) | Special Considerations for Retirees |

| 🇺🇸 USA | Private Pensions are generally taxed only in Spain (the country of residence). U.S. Social Security benefits are generally taxable only in the USA. | U.S. Citizenship-Based Taxation: U.S. citizens and Green Card holders must always file a U.S. tax return reporting worldwide income, regardless of where they live. They use the Foreign Tax Credit (FTC) or other mechanisms to offset Spanish taxes paid. Roth IRAs are often not recognized as tax-exempt in Spain and may be taxed upon withdrawal. |

| 🇬🇧 UK | UK State and Private/Occupational Pensions are generally taxed only in Spain. UK Government Service Pensions (e.g., Civil Service, Police, Military) are generally taxed only in the UK. | QROPS: Transfers to a Qualifying Recognised Overseas Pension Scheme can be subject to significant Spanish tax charges if made after becoming a Spanish tax resident. UK government pensions, though only taxed in the UK, must still be declared in Spain for “progression” purposes (to determine the tax rate applied to other Spanish-taxable income). |

| 🇩🇪 Germany | Private Pensions are generally taxed only in Spain. German State Pensions (e.g., statutory pension insurance) and Government Service Pensions are generally taxed only in Germany. | The treaty ensures that German pensions, if only taxable in Germany, must still be declared in Spain for progression purposes. The specific rules depend heavily on the type of pension fund (statutory vs. private). |

| 🇫🇷 France | Private Pensions are generally taxed only in Spain. French Government Service Pensions are generally taxed only in France. | Income from certain French private savings plans (e.g., life assurance policies) must be carefully assessed, as their tax treatment in Spain may differ from their tax-privileged status in France. Similar to the UK and Germany, French government pensions must be declared for Spanish progression. |

📌 Important Takeaway

While the DTTs aim to eliminate double taxation, they do not eliminate the requirement to file tax returns in both countries. In all cases, Spanish tax residents must declare their worldwide income in Spain. The DTT then provides the mechanism (either an exemption or a tax credit) to reduce or eliminate the Spanish tax due on foreign-source income that may still be taxed in the country of origin.