Essential Spanish Tax Hub for Retirees

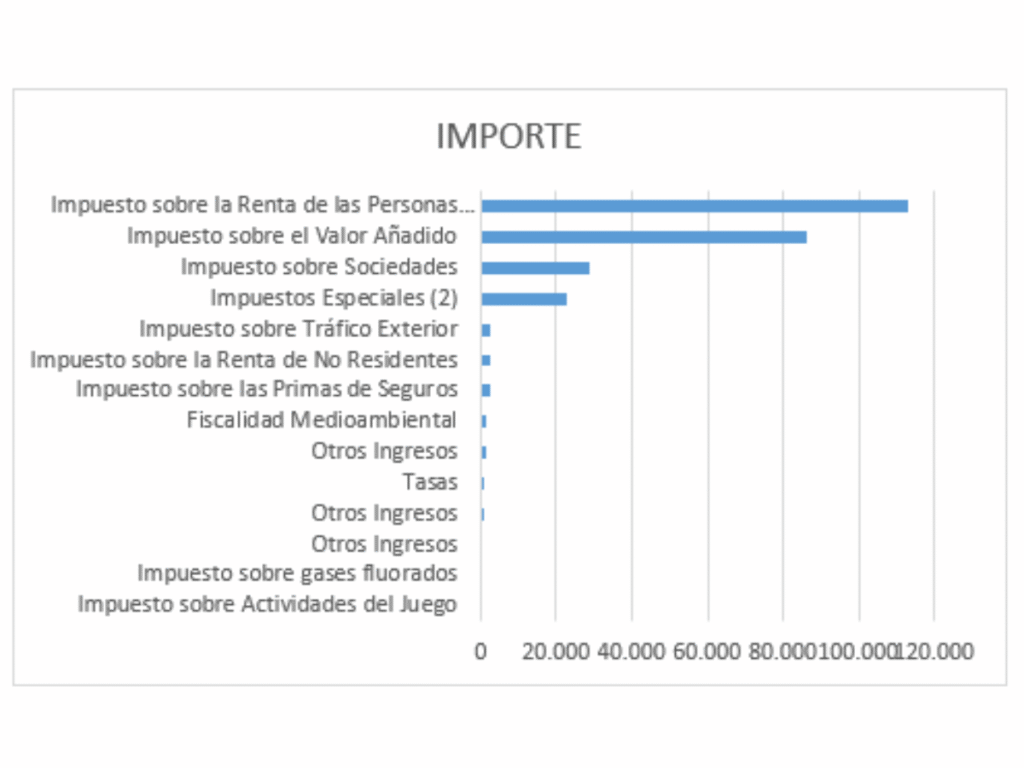

“Essential Tax Planning Hub for Senior Retirees,” focusing on simplification, and senior-specific concerns. The focus will be on the three main taxes affecting residents: Income Tax (IRPF), Wealth/Solidarity Tax (IP/ITSGF), and the Foreign Assets Declaration (Modelo 720/721).

Key data points are confirmed:

- ITSGF Status: Active in 2025.

- IP Exemptions (Residents): The €700,000 personal allowance and the €300,000 main residence.

- IRPF Senior Allowances:

- Age 65+: €6,700

- Age 75+: €8,100

- Filing Dates: Modelo 720/721 by March 31; IRPF/IP/ITSGF in July.

Module 1: Your Foundation – The Tax Resident Checklist

The single most important factor is your Tax Residency Status.

| 📌 Senior Resident Checklist: Am I a Spanish Tax Resident? |

| If you answer YES to any of these during a calendar year (Jan 1 – Dec 31), you are a Spanish Tax Resident and taxed on your WORLDWIDE income/assets. |

| 1. Did you spend more than 183 days in Spain? (Days do not have to be consecutive.) |

| 2. Is the main base of your economic activities (e.g., biggest source of investment income) in Spain? |

| 3. Does your spouse and/or dependent children habitually reside in Spain? |

| — |

| Why this matters for retirees: Renewing the Non-Lucrative Visa requires you to live in Spain for 183+ days, automatically making you a Tax Resident. |

Module 2: Income Tax (IRPF) – The Pension Puzzle

For seniors, IRPF is primarily about how pensions and investment income are taxed.

How Your Pension is Taxed

- Rule 1: Worldwide Income. As a resident, you must declare all your worldwide pension income, interest, and dividends.

- Rule 2: The Tax Treaty is Key. Spain has treaties (DTAs) with many countries (UK, US, Canada, etc.) to prevent double taxation.

- Public/Government Pensions: Usually only taxable in the country that pays them (e.g., UK State Pension often taxed only in the UK).

- Private Pensions (401k, Private Schemes): Usually taxable only in Spain (your country of residence).

- The €7,200/€8,100 Allowance: Spain provides age-based tax-free personal allowances (minimums), which automatically reduce your income subject to tax:

- Ages 65-74: Personal Allowance of €6,700

- Ages 75+: Personal Allowance of €8,100

💡 Senior Tax Advantage Example: Selling Your Home

| Action | Senior Tax Benefit (Age 65+) |

| Sale of Main Residence | The entire capital gain from selling your main Spanish residence is 100% EXEMPT from Income Tax (IRPF) if you are over 65. |

| Sale of Other Assets (e.g., shares, second home) | The capital gain is exempt from tax, up to a limit of €240,000, if the proceeds are used to purchase an annuity within six months. |

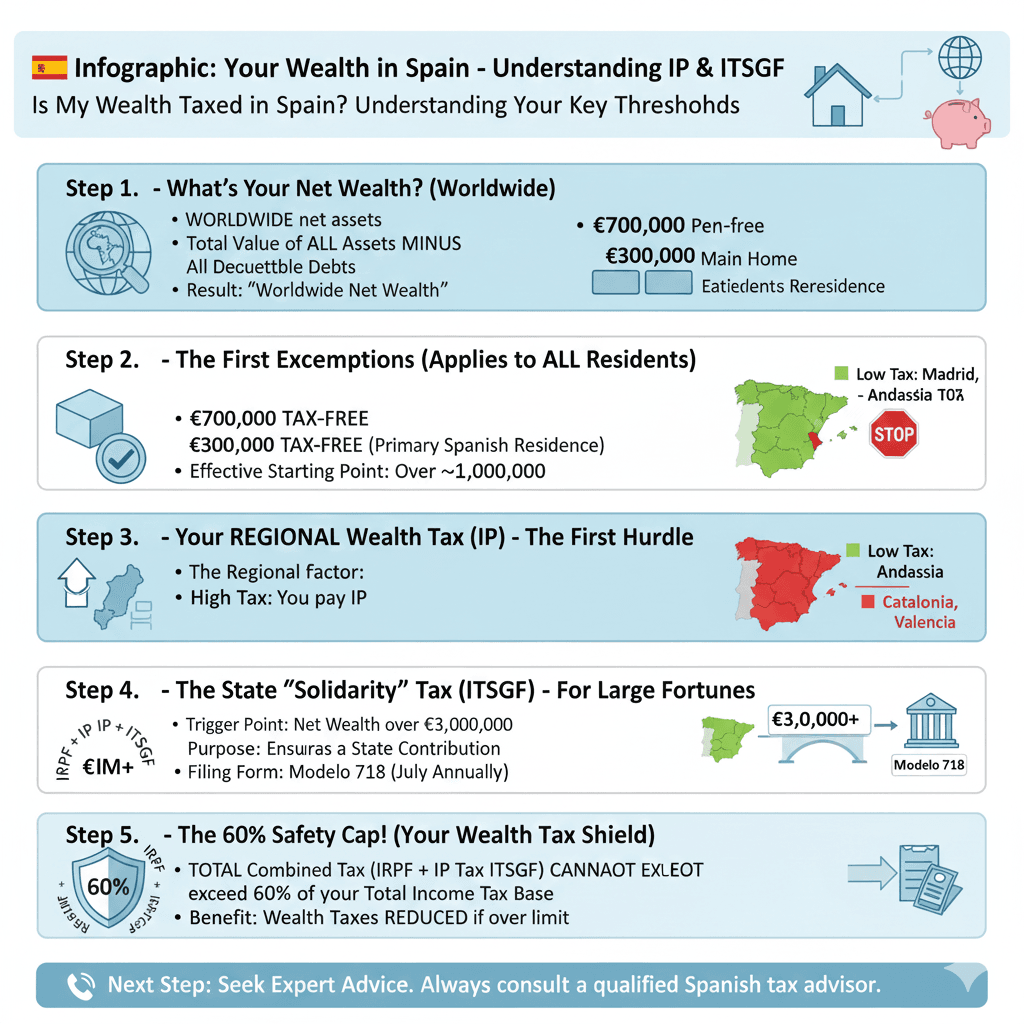

Module 3: Wealth & Solidarity Tax (IP & ITSGF)

This section must be simplified by focusing on the net wealth thresholds and the main residence exemption.

💰 Your Wealth Tax (IP) Snapshot

| Feature | Detail |

| Taxed On | Your Worldwide Net Wealth as of December 31st. |

| Personal Exemption | €700,000 is deducted from your worldwide net assets. |

| Main Residence Exemption | An additional €300,000 is exempt for your primary Spanish residence. |

| Effective Threshold | Your total net worldwide assets must exceed €1,000,000 (for most people) before you pay any IP. |

| The Regional Factor | IMPORTANT: This tax is heavily managed by the Autonomous Community (CC. AA.). Some regions (e.g., Madrid, Andalusia) apply a 100% discount, meaning you pay €0 for the regional IP. |

💸 The Solidarity Tax (ITSGF) – The Safety Net

This temporary state tax ensures high-net-worth individuals pay a minimum.

| Feature | Detail |

| Trigger Point | Net wealth must exceed €3,000,000 (after the €700k exemption). |

| Purpose | If your region gives you a 100% discount on the regular IP, the ITSGF steps in to charge the tax instead. |

| The 60% Safety Cap | Your total combined tax bill for Income Tax + Wealth Tax + ITSGF cannot exceed 60% of your income tax base. This prevents the combined taxes from becoming excessive. |

| Filing Form | Modelo 718 (if the final amount due is > €0.00). |

Module 4: The Foreign Asset Reporting Requirement (Modelo 720/721)

This is a mandatory information return, not a tax payment. It is crucial for seniors with foreign pensions, investments, and property.

| 🔔 Modelo 720/721: Your Foreign Assets Declaration |

| WHO: All Spanish Tax Residents. |

| WHAT: You must declare any asset (accounts, investments, property) held outside Spain if the total value in any single category exceeds €50,000 as of December 31st. |

| WHEN: File electronically between January 1st and March 31st each year. |

| WHY: Severe penalties apply for non-compliance, even if no tax is due. It tells the Spanish Tax Agency (AEAT) where your worldwide assets are located. |

📝 Your Annual Tax Compliance Checklist

Use this simple list to keep track of your tax obligations:

| ✅ Senior Tax Filing Checklist (Due Dates) | Status |

| Modelo 720/721 (Foreign Assets) | Due: Jan 1 – Mar 31 |

| Modelo 100 (IRPF – Income Tax) | Due: Apr 1 – Jun 30 |

| Modelo 714 (IP – Wealth Tax) | Due: Apr 1 – Jun 30 |

| Modelo 718 (ITSGF – Solidarity Tax) | Due: Jul 1 – Jul 31 |

| Review DTA Status | Annually |

📞 Next Step: Seek Expert Advice

Tax planning is not DIY. Because of the complexity of pension classification (public vs. private), the regional variations in Wealth/Inheritance Tax, and the need to correctly apply Double Taxation Treaty credits, you must consult a specialist advisor who understands both Spanish tax law and the tax system of your home country (e.g., US/UK/Canada).